Vietnam is an investment “hot spot” for multinational electronics companies; in which, the North quickly became the world’s factory…

Vietnam’s electronics industry has developed rapidly in recent years and has promising prospects in the future.

Currently, Vietnam ranks 12th in the world in exporting electronic products of many types, from mobile phones, televisions to integrated circuits.

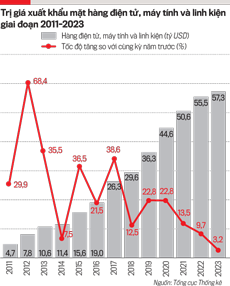

ELECTRONICS EXPORTS CONTINUE TO INCREASE

According to the General Statistics Office, in the first 8 months of 2024, exports of electronics, computers and components ranked “champion” in 7 commodity groups with a turnover of over 10 billion USD of Vietnam, reaching 46.32 billion USD, up 28.9% over the same period in 2023.

In the period from 2011 to 2023, the group of electronics, computers and components continuously achieved a high growth rate, respectively: in 2011 it increased by 29.9%; in 2012, it increased by 68.4%; in 2013, it increased by 35.5%; in 2014, it increased by 7.5%; in 2015, it increased by 36.5%; in 2016, it increased by 21.5%; in 2017, it increased by 38.6%; in 2018, it increased by 12.5%; in 2019 and 2020 both increased by 22.8%; in 2021, it will increase by 13.5%; in 2022 it will increase by 9.7% and in 2023 it is estimated to increase by 3.2%. On average, the whole period 2011-2023 increased by 23.8%.

The North excels in attracting foreign investment, accounting for 78% of large projects and total investment capital of up to 81% of the entire electronics industry in Vietnam. Next is the South with a proportion of 17% of the number of investment projects. The Central region has tended to grow in attracting foreign capital in recent years, in the period 2013 – 2016 it only attracted 2-3% of the number of projects, but by 2022, this rate has reached 10% and is on a clear upward trend.

The strong growth of electronics, computers and components has contributed to the export turnover of this group of goods to become the largest main export group of Vietnam in 2023 (reaching 57.3 billion USD).

Notably, the outstanding growth of the electronics industry has the contribution of many foreign-invested enterprises. According to the Vietnam Association of Supporting Industries (VASI), foreign investment usually accounts for 80-100% of the total investment capital of the electronics industry. While the investment capital of domestic enterprises or FDI enterprises with investment capital of domestic enterprises accounts for a small proportion.

The North excels in attracting foreign investment, accounting for 78% of large projects and total investment capital of up to 81% of the entire electronics industry in Vietnam. Next is the South with a proportion of 17% of the number of investment projects. The Central region has tended to grow in attracting foreign capital in recent years, in the period 2013 – 2016 it only attracted 2-3% of the number of projects, but by 2022, this rate has reached 10% and is on a clear upward trend.

With the main focus of economic and trade policies is the signing of free trade agreements to facilitate foreign investment in factory construction and export. Trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) and the Free Trade Agreement with the European Union (EVFTA) are expected to continue to promote foreign investment in Vietnam.

MANY COMPETITIVE ADVANTAGES

The Vietnam Taiwan (China) Business Forum 2024 said that Taiwan’s investment in Vietnam is on the rise. Vietnam has become the first choice of Taiwanese businesses to shift investment from China due to the impact of the US-China trade war.

According to a summary by Commonwealth Magazine and Taiwan Technology Network, many leading electronics companies in the world are currently focusing on investing in industrial parks in the north of Vietnam, such as: Samsung, LG Display, Fuji Xerox, Canon, Meiko, Panasonic, Compal, Foxconn, Pegatron, Goertek, Luxshare, Wistron, Lens, etc Inventec, Risun, WNC…

These companies are mainly located in industrial parks in the provinces of Bac Ninh, Bac Giang, Thai Nguyen, Hai Phong, Quang Ninh, Ha Nam… The region is popular for its geostrategic location, proximity to China, excellent transport infrastructure and competitive industrial land costs. In particular, the North is expected to quickly develop into Vietnam’s main electronics manufacturing center, attracting more multinational companies to invest directly.

Recent major projects include: LG Display Hai Phong (increased investment capital of 750 million USD), Fukang Bac Giang Technology Factory (293 million USD) and JinkoSolar photovoltaic project Quang Ninh (498 million USD). Foreign direct investment enterprises invest in large-scale high-tech projects in important fields such as electronics, proving Vietnam’s stability and prestige in attracting global investment.

In the ranking of global foreign direct investment (FDI) attractiveness, Vietnam ranks 25th (out of a total of 60 countries). This ranking puts Vietnam ahead of other FDI powerhouses in Southeast Asia such as Indonesia, the Philippines and Thailand. Vietnam’s competitive advantage stems from the strategy of reducing total FDI costs as well as the large domestic market size and strong consumption power.

Among the investment options of Japanese companies, Vietnam also ranks first. Of the 122 Japanese companies surveyed, 42.3% of businesses chose Vietnam as an investment destination, far surpassing Thailand (20.6%), the Philippines (18.6%) and Indonesia (16.5%). Japanese companies are moving away from China not only because of the trade war, but also to avoid rising input costs in the Chinese market.

In general, Vietnam is becoming an attractive investment destination with a favorable business environment, supportive policies of the Government and great growth potential…

(*) LS. Bui Van Thanh, Head of New Sun Law Office, Standing Vice Chairman of the Vietnam Industrial Park Finance Association (VIPFA).

———-

The content of the article was published in the Vietnam Economic Journal No. 38-2024 published on September 16, 2024. Readers are invited to find and read here:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam